Скачайте приложение

-

- Торговые платформы

- Приложение PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Веб-трейдер

- ПУ Социальный

-

- Условия торговли

- Типы счетов

- Спреды, Расходы и Свопы

- Вклады и Снятие

- Платежи и Сборы

- Время торговли

Скачайте приложение

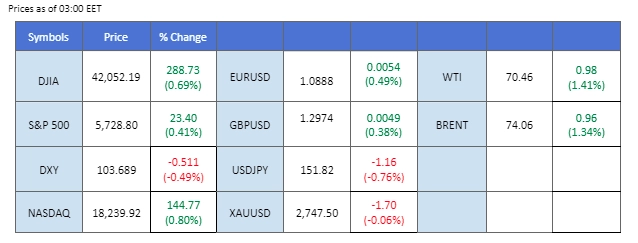

Market Summary

The dollar continued to face selling pressure after U.S. jobs data released last Friday showed significantly lower-than-expected numbers. While the unemployment rate aligned with market expectations at 4.1%, the Nonfarm Payroll came in at just 12,000—one of the lowest figures since the Fed began its tightening cycle. This has fueled expectations for a more accommodative Fed stance to support the job market, leading to a plunge in the dollar. Apart from the Fed’s upcoming rate decision, traders are also focusing on the RBA and BoE monetary policy decisions due this week.

In the commodity market, gold faced strong profit-taking after hitting $2,790 for the first time. However, with both the U.S. presidential election and Fed’s rate decision set for this week, these events may continue to support gold’s price. Oil prices jumped over 1% to start the week as OPEC+ decided to delay its planned production increase for December. Additionally, heightened geopolitical risks in the Middle East, including threats from Iran, could further boost oil prices.

In the crypto market, BTC dropped to $67,000 over the weekend, erasing gains from the previous week and wiping out over $200 million in the crypto derivatives market. Increased volatility is expected in the crypto space this week as market sentiment aligns closely with the U.S. election.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (4.4%) VS -25 bps (95.6%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index slipped as US Nonfarm Payrolls saw minimal gains, marking the slowest increase since 2020. The Bureau of Labor Statistics reported only a 12,000-job increase, falling short of expectations and hinting at a cooling labor market. While the Unemployment Rate held steady at 4.1%, matching forecasts, temporary disruptions like recent hurricanes likely impacted hiring, albeit briefly. With the focus shifting to the upcoming US Presidential election, any substantial movement in the dollar is limited for now. Investors should monitor election developments closely for clearer dollar trend signals.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 36, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.20, 104.60

Support level: 103.85, 103.45

Gold prices stayed largely flat, with slight dips despite the subdued payroll data. The declines were primarily due to profit-taking and technical adjustments. Concerns about upcoming events, including the US election, continue to suggest potential volatility in the gold market. For further trend confirmation, investors should keep an eye on election results and subsequent impacts on market sentiment.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2755.00, 2785.00

Support level: 2735.00, 2715.00

The British Pound remains under pressure and could experience heightened volatility this week ahead of the Bank of England’s interest rate decision on Thursday. While the pair is currently finding some support from the weakening dollar, it has yet to break through the 1.3000 psychological resistance level, indicating a bearish bias. Traders should monitor the BoE’s decision closely, as it could be pivotal for the Pound’s direction.

GBP/USD surged from its recent low level but is facing strong selling pressure near the 1.3000 mark; a break above such a level may be a trend reversal signal for the pair. The RSI remains below the 50 level, while the MACD has yet to break above the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.3040, 1.3125

Support level: 1.2940, 1.2815

The EUR/USD pair has developed a triple-bottom pattern and is trading in a higher-high formation, indicating a bullish bias. The recent movement has been largely driven by disappointing U.S. job data released last Friday. With both the U.S. presidential election and the Federal Reserve’s monetary policy decision scheduled for this week, the pair is likely to encounter significant volatility in the days ahead.

EUR/USD had a trend reversal from its recent low level near the 1.0770 mark; the pair then broke its resistance level at 1.0895, suggesting a bullish bias for the pair. The RSI is gradually moving upward while the MACD has broken above from the zero line, suggesting that the pair is trading with bullish momentum.

Resistance level: 1.0950, 1.1020

Support level: 1.0813, 1.0736

The AUD/USD pair surged at the start of the week in anticipation of the Reserve Bank of Australia’s (RBA) interest rate decision due tomorrow. While markets generally expect the RBA to keep rates unchanged, recent weak economic indicators from Australia may influence the board’s decision-making. Should the RBA signal concerns over economic weakness, the Aussie could see a near-term decline.

The AUD.USD pair jumped above from the price consolidation range suggesting a bullish bias for the pair. The RSI has broken above the 50 level while the MACD edges higher, suggesting the pair has a growing bullish momentum.

Resistance level: 0.6670, 0.6730

Support level: 0.6550, 0.6490

US stocks rebounded by week’s end as traders shifted focus from mixed economic data and election uncertainties to strong corporate earnings. Tech giants led the charge, with Amazon and Intel showing impressive gains following upbeat results. Boeing also rose amid optimism about resolving a labor strike, while ExxonMobil and Chevron outperformed on earnings, production, and sales. However, Apple saw a slight dip after issuing a cautious forecast, tempering the tech sector’s broader rally.

Nasdaq is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 44, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 20575.00, 21075.00

Support level: 19860.00, 19120.00

Oil prices edged higher in early Asian trading following reports of potential Iranian attacks on Israel from Iraqi territory. Reports indicate Iran may utilise drones and ballistic missiles from Iraq, escalating geopolitical risks. Furthermore, speculation about OPEC+ potentially delaying a planned production increase in December is providing additional support, reflecting concerns about sluggish global demand and increasing supply levels.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 72.60, 74.75

Support level: 69.90, 68.45

Торгуйте валютными парами, индексами, Металлы и другими активами с минимальными в отрасли спредами и молниеносным исполнением.

Открывайте реальный счет в PU Prime без особых усилий.

Легко пополняйте счет с помощью широкого ассортимента операторов и валют.

Получите доступ к сотням инструментов с лучшими торговыми условиями на рынке.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!