Скачайте приложение

-

- Торговые платформы

- Приложение PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Веб-трейдер

- ПУ Социальный

-

- Условия торговли

- Типы счетов

- Спреды, Расходы и Свопы

- Вклады и Снятие

- Платежи и Сборы

- Время торговли

Скачайте приложение

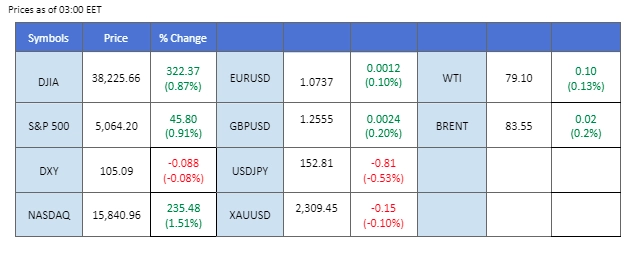

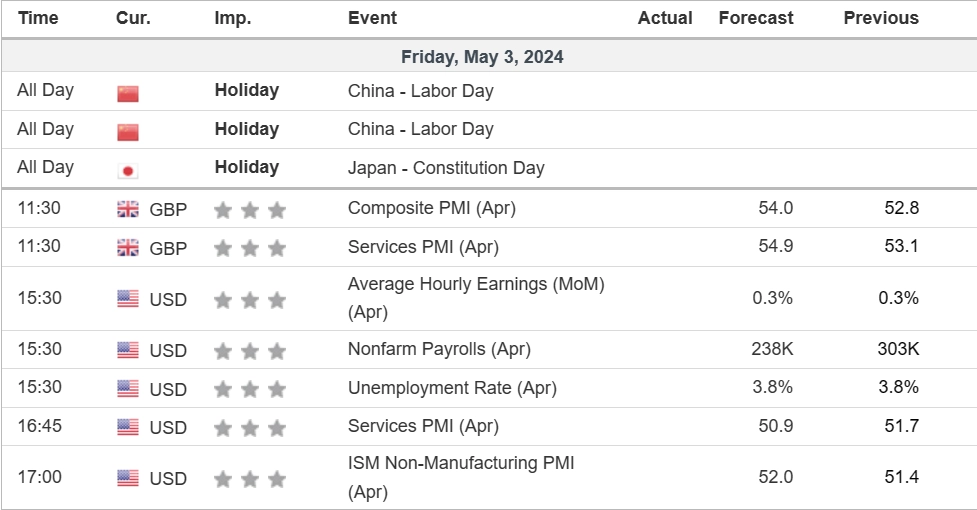

Following Jerome Powell’s remarks subsequent to the Fed’s interest rate decision announcement, equity markets rallied in response to the dovish tone from the Fed chief, while the Dollar index continued its decline. The Fed’s dismissal of another rate hike possibility, despite persistent inflation in the U.S., contributed to the Dollar’s weakening. Market attention now shifts to today’s U.S. NFP reading, which could provide insights into the Fed’s forthcoming monetary policy decisions.

In the commodities market, prices for assets such as gold and oil remained subdued, primarily due to positive developments in Middle East tensions. Oil prices, in particular, were affected by a significant surge in U.S. crude stockpiles and lacklustre economic performance in China.

Across the forex landscape, major currencies, including the Sterling and the euro, traded higher against the U.S. dollar ahead of the NFP reading. However, the Japanese Yen outperformed, reaching a three-week high amidst suspected intervention by Japanese authorities. Market participants are eagerly awaiting comments from the Japan Finance Minister and BoJ governor, both of whom are scheduled to hold a press conference in Tbilisi on the sidelines of the 57th Asian Development Bank meeting.

Current rate hike bets on 12th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.2%) VS -25 bps (11.8%)

(MT4 System Time)

Source: MQL5

The Dollar Index, which tracks the greenback against a basket of major currencies, extends its losses following the Federal Reserve’s interest rate decision. Investors grapple with the implications of the Fed’s perceived dovish stance, prompting profit-taking ahead of key economic events. With attention shifting back to economic data releases, market focus centres on deciphering signals regarding future monetary policy directions. Anticipation builds for upcoming reports, including Nonfarm Payrolls and the Unemployment Rate, which are poised to provide critical insights into market sentiment.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 35, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 105.70, 106.35

Support level: 105.20, 104.60

Gold prices remain stable and trade flat amid mixed market sentiment, with investors awaiting key economic data releases. Despite a recent depreciation of the US Dollar fueled by dovish remarks from Federal Reserve members, gold’s losses are limited amidst easing tensions in the Middle East. Market participants closely monitor major events, including the release of crucial jobs reports and ongoing negotiations in the Middle East, for indications of market direction and trading opportunities.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2330.00, 2360.00

Support level: 2300.00, 2270.00

The GBP/USD pair continues its upward trajectory, currently encountering short-term resistance at the 1.2560 level. The rally was primarily driven by the dovish comments from Fed Chair Jerome Powell last Wednesday, indicating that another rate hike from the Fed is less likely despite persistent inflation in the U.S. Market focus now shifts to today’s Non-Farm Payroll (NFP) data, which is anticipated to offer further insights into the Fed’s upcoming monetary policy decisions.

The GBP/USD consolidated after breaking out from the uptrend channel, suggesting the bullish trend remains. The RSI is flowing above the 50 level, while the MACD did not fall below the zero line, suggesting the pair remains trading with bullish momentum.

Resistance level: 1.2660, 1.2760

Support level: 1.2440, 1.2370

The EUR/USD pair has rallied, now testing its short-term resistance at the 1.0740 level. The euro initially weakened following a lower-than-expected CPI reading, which is edging closer to the ECB’s target rate of 2%. However, the currency found support from the dovish stance taken by the Federal Reserve following its latest interest rate decision announcement. Moving forward, the pair’s trajectory is expected to be significantly influenced by today’s U.S. Non-Farm Payroll (NFP) data, which could provide critical insights into the Fed’s future monetary policy actions.

The pair is currently testing its short-term resistance level at 1.0740 with sufficient bullish momentum. The RSI is gradually moving upward, while the MACD shows signs of rebounding from above the zero line, suggesting the pair remains trading with bullish momentum.

Resistance level: 1.0775, 1.0865

Support level: 1.0700, 1.0630

The Hang Seng Index has exhibited strong bullish momentum over the past two weeks, surging by nearly 15%. This remarkable rally has been fueled by several factors, including the dovish stance adopted by the Federal Reserve, which has boosted risk appetite across the board. Additionally, the Chinese government’s monetary easing policies have played a significant role in attracting capital inflows into the Hang Seng Market. These policies have effectively bolstered investor confidence, propelling the index to reach its highest level in 2024.

HSI has broken its second psychological resistance level at 18000 and continues to climb, suggesting strong bullish momentum. The RSI and the MACD both edge higher, suggesting the index is trading with extreme bullish momentum.

Resistance level: 19340.00, 20650.00

Support level: 18190.00, 17210.00

The Japanese yen gained significant bullish momentum in early Asian trading hours, with market participants speculating on potential intervention by the Bank of Japan (BOJ). The BOJ and Japanese Finance Minister have reiterated their commitment to monitoring currency movements closely, suggesting possible intervention if the yen’s stability is compromised. The currency’s upward trajectory reflects ongoing concerns about its strength and underscores heightened vigilance among investors.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the pair might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 154.70, 158.45

Support level:151.70, 149.40

Crude oil prices experience a significant downturn, testing support levels amid ongoing ceasefire negotiations in the Middle East and unexpected increases in inventory data. The possibility of a ceasefire agreement coupled with higher-than-anticipated production levels adds pressure on oil prices, signalling a bearish sentiment in the market. Investors closely monitor developments in the Middle East and inventory dynamics for potential shifts in oil market dynamics and trading signals.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the commodity might enter oversold territory.

Resistance level: 80.45, 81.90

Support level: 78.00, 75.95

Торгуйте валютными парами, индексами, Металлы и другими активами с минимальными в отрасли спредами и молниеносным исполнением.

Открывайте реальный счет в PU Prime без особых усилий.

Легко пополняйте счет с помощью широкого ассортимента операторов и валют.

Получите доступ к сотням инструментов с лучшими торговыми условиями на рынке.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!